Orbia Tax Policy

1. Introduction

Orbia Advance Corporation (“Orbia” or the “Company”) is a global company committed to maintaining the highest standards of corporate governance, sustainability, and ethical practices. In line with these principles, Orbia Management and the Board of Directors have developed a comprehensive tax policy emphasizing transparency, compliance, and responsible tax practices. This policy, along with our Code of Ethics, aims to ensure that our tax practices align with our business objectives while fulfilling our obligations to society and the jurisdictions in which we operate.

Our tax policy demonstrates our commitment to responsible tax practices, compliance with tax laws, and transparency in our business operations. By adhering to this policy, we aim to maintain trust with our stakeholders, contribute to the economies in which we operate, and fulfill our broader responsibilities towards society.

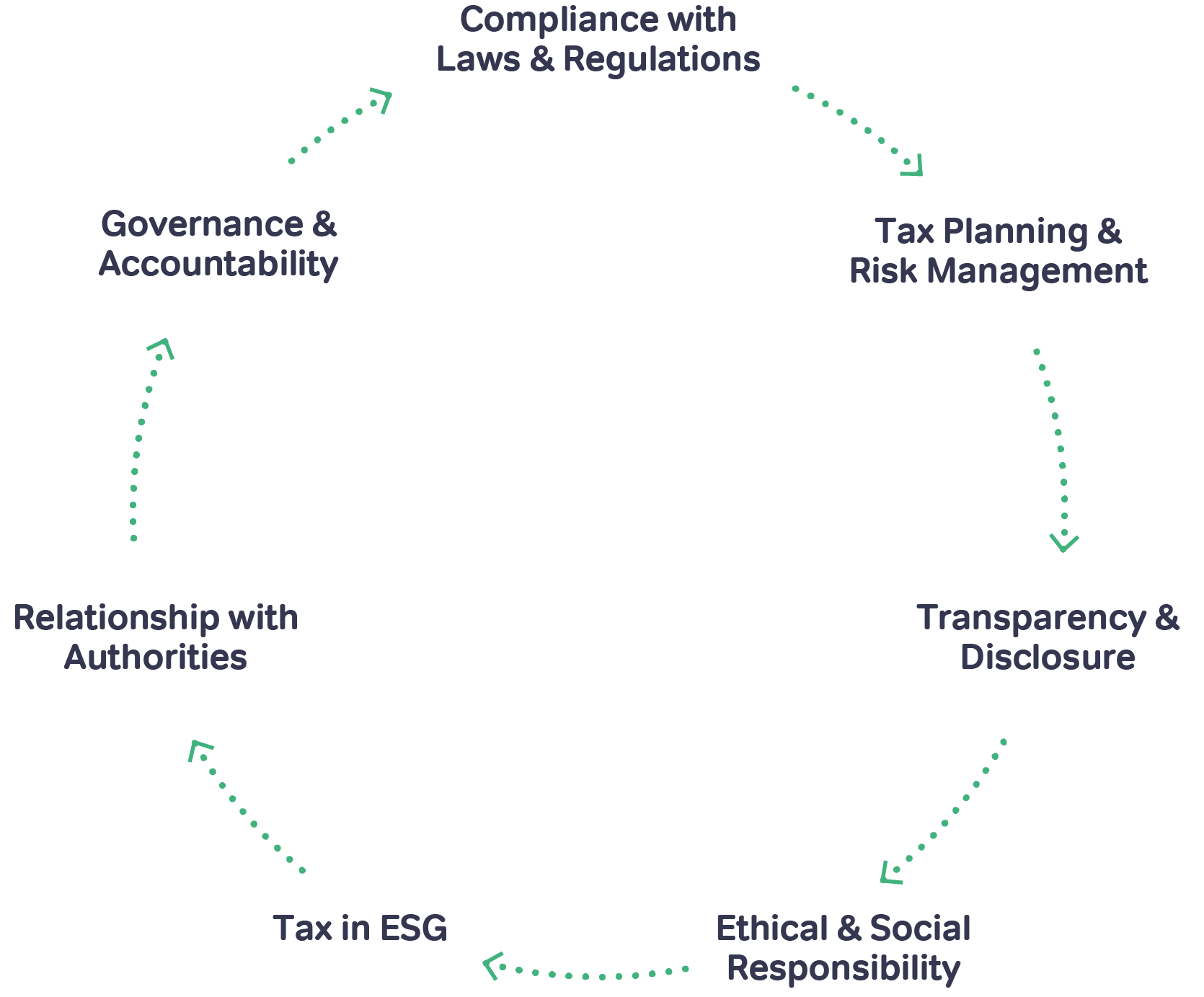

2. Pillars of Our Tax Policy

Compliance with Laws and Regulations: We are committed to strict compliance with all applicable tax laws, rules, and regulations in the jurisdictions in which we operate. We strive to accurately determine and comply with our tax obligations, including all reporting and payment requirements. We work closely with our internal and external tax advisors to stay updated on changes to tax legislation and implement any necessary adjustments in our compliance processes.

Tax Planning and Risk Management: While striving for compliance, we also recognize the importance of responsible tax planning within the boundaries of the law. Tax planning aims to maximize efficiency while minimizing risks. Our tax planning activities prioritize economic substance over artificial structures, and we engage in legitimate tax planning strategies to ensure that we utilize available incentives, deductions, and credits while considering long-term implications. However, we will not engage in aggressive tax planning that lacks economic substance or seeks to exploit tax loopholes.

Transparency and Disclosure: We are committed to maintaining a high level of transparency in our tax practices. We recognize the growing demand for transparency regarding tax and financial information. We voluntarily disclose relevant tax-related data in accordance with international standards, including country-by-country reporting. In addition, we ensure that all relevant tax information is accurately disclosed in our financial statements and reports in compliance with applicable accounting standards and regulations. This enables stakeholders to assess our tax practices, contributions to economies, and compliance with tax obligations in various jurisdictions.

Tax in ESG: We believe tax plays a critical role in our approach to compliance and transparency in the areas of environmental, social, and governance (ESG). Tax is an accelerator in reaching our ESG goals by serving as a crucial tool for incentivizing sustainable practices and responsible corporate behavior. Orbia is a purpose-driven organization, and our sustainable approach to taxes enables our organization to innovate by being eco-friendly, addressing social issues, and promote promoting transparent corporate governance. By aligning our tax governance framework with sustainability, we integrated ESG into our tax strategy, fostering a sustainable organization.

Ethical and Social Responsibility: We conduct our tax activities in an ethical manner, ensuring alignment with our broader corporate values. We acknowledge our responsibility to contribute to the societies in which we operate by paying our fair share of taxes. We do not engage in tax evasion, aggressive tax avoidance, or any artificial structures that lack commercial substance. Our tax activities are consistent with our sustainability initiatives, supporting environmental protection and social development.

Relationship with authorities: We seek to develop cooperative relationships with tax authorities based on trust and mutual respect. We actively cooperate with tax authorities and respond to their inquiries promptly and transparently. Our aim is to foster an open dialogue and build constructive relationships with tax authorities in a straightforward and timely manner where both parties engage proactively in discussions related to Orbia’s tax planning strategy, transfer pricing policy, and significant business transactions. In addition, we seek to enter into early dialogue with tax authorities to resolve misunderstandings, disagreements, and material uncertainties about the tax rules and regulations that apply to our operations. Finally, we will not bribe or otherwise induce tax officials or government officials with the aim of obtaining beneficial outcomes with respect to Orbia tax matters.

Governance and Accountability: Our tax function and tax policy are driven by a robust tax governance framework. Effective governance ensures accountability, clear roles and responsibilities, and regular monitoring of tax compliance and reporting.

Our commitment does not stop here; we seek feedback and perform benchmarking analysis. We regularly review and update our tax policy to ensure its alignment with best practices and ever-changing regulatory environments.

3. Accountability & Governance Framework

| The Board | |

| Tax is a core part of corporate responsibility and governance. Our Board of Directors sets the tone at the top and approves the tax strategy. The Board is accountable for the oversight of the tax strategy and delegated the responsibility for tax risk management to the tax department with oversight by the Audit Committee. | |

| The Audit Committee | |

| The Audit Committee is responsible for detailed risk oversight, oversight over tax compliance status, managing relationships with external advisors and auditors, and assessing and monitoring the effectiveness of the Tax Policy. | |

| The first line of defense: CFO (& Designees) | The second line of defense: Tax Leadership |

|

|

|

Tax Planning and Risk Management Transparency and Disclosure Ethical and Social Responsibility Tax in ESG Relationship with Authorities Governance and Accountability |

|