Decarbonizing Process Heat: VC Opportunity Landscape

June 2025

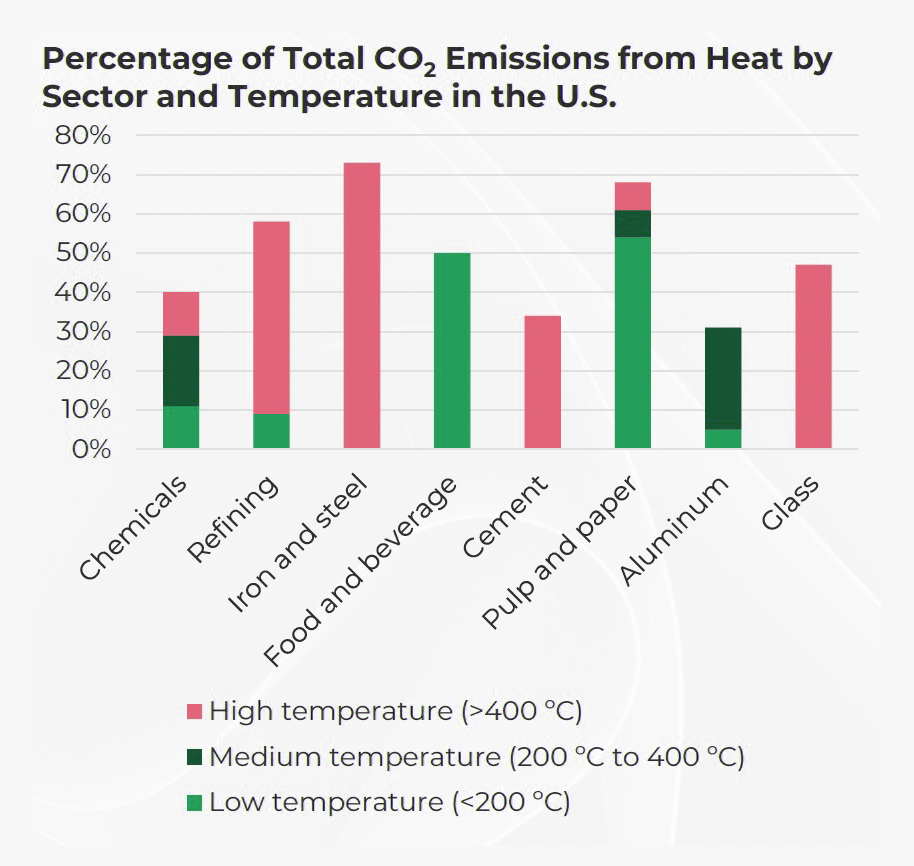

Executive SummaryDespite being responsible for roughly 25% of global CO₂ emissions, industrial process heat remains among the most difficult sectors to decarbonize due to diverse temperature needs, geographic differences and cost challenges. However, our analysis suggests that selective venture opportunities are emerging—particularly in high-temperature heat pumps and enabling components such as turbocompressors and advanced refrigerants, which meet both economic and technological readiness criteria. Other areas, including thermal energy storage and electrochemical reduction, are showing rapid progress and capital formation, making them relevant for later-stage VC investors. Emerging solutions like plasma heating, inductive systems and next-gen materials also merit attention for their long-term potential to reshape the landscape. Understanding Process Heat: Market Landscape, Challenges, and SegmentationIndustrial process heat refers to the thermal energy required to drive manufacturing and chemical transformation across a wide range of industries, such as steelmaking, cement production, petrochemicals, food processing and pulp and paper. It accounts for roughly 25% of global CO₂ emissions and 19% of total global energy consumption,1,2 making it one of the largest single contributors to climate change. Unlike power or transportation, where decarbonization technologies are well-established, process heat is technically and commercially harder to address. It spans a vast range of temperatures, is often embedded in legacy systems and tends to be capital-intensive with long asset lives. |

How to Segment the Market: By Temperature

|

A foundational way to understand the process heat market is by segmenting it according to temperature range. Different industrial processes require different levels of heat intensity, and these bands often align with sector-specific applications:

These temperature bands help define the industrial roles of process heat and the physical form in which heat is delivered (e.g., steam, hot air, direct flame).1,2 |

|

How to Segment the Market: By GeographyLocal energy prices, carbon policies and industrial structure significantly shape decarbonization feasibility, as well as local infrastructure and grid readiness:

The same technology can have vastly different ROI and adoption potential depending on where it's deployed.1,2 For early-stage innovation, regional targeting is often as important as technical performance. Decarbonization Pathways by Temperature BandBefore identifying investable opportunities, it is important to understand how different temperature ranges are being targeted by decarbonization strategies. Each band is characterized not only by distinct industrial applications but also by the types of solutions currently being developed or deployed to reduce emissions.

This landscape is important not just for understanding technical fit, but also for clarifying where venture-scale opportunities may or may not exist. |

Our Approach to Identifying VC OpportunitiesGiven the scale and diversity of the industrial heat landscape described above, we sought to understand whether there are venture capital opportunities to support its decarbonization. To answer this question, we defined three broad VC categories: |

1. Early-Stage VC OpportunitiesCompanies that meet three core criteria:

2. Later-Stage VC OpportunitiesCompanies or segments that may meet the technical and economic criteria but are likely beyond the reach of early-stage VC due to maturity, capital intensity or valuation. 3. Emerging OpportunitiesPre-seed technologies that do not yet meet the two core criteria (i.e. science risk and LCOH), but that could potentially disrupt specific applications within the process heat industry. |

Early-Stage VC Opportunities

1. High-Temperature Heat Pumps

High-temperature heat pumps aim to electrify steam and process heat applications traditionally served by fossil-fueled boilers in the 200–400°C range. They are relevant to pulp & paper, chemicals and other mid-temp industrial sectors and represent a key decarbonization lever as electrification pushes beyond low-grade heat.

- Large industrial demand at this temp band, historically served by gas-fired steam systems.

- Electrification of medium-temperature heat (200–400°C) remains limited today but is gaining momentum in regions with high fossil fuel prices, where electric systems are becoming cost-competitive.

- Recent technological advancements now enable heat pumps to operate efficiently at higher temperature ranges (200–400°C), whereas earlier generations were limited to 100–150°C.

- Early success with pilot systems in EU and U.S. points to technical viability.

2. Components and Materials Enabling Electrification

These are the subsystems and materials that enable electrification technologies—like heat pumps and electric boilers—to operate effectively in industrial environments. They include high-performance refrigerants, turbocompressors, corrosion-resistant seals and thermal coatings.

- Industrial settings require longer lifetimes, chemical resistance and efficiency under pressure.

- As OEM systems mature, performance-limiting components present bottlenecks and differentiation opportunities.

- Evari | High-efficiency turbocompressors that support next-gen heat pump systems.

Later-Stage VC Opportunities

1. Electrification of Low-Temperature Heat (<200°C)

Common in food & beverage, light chemicals and textile processing. Typical use cases include sterilization, cleaning, drying and pasteurization—processes that often rely on steam or hot water.

- Commercially mature technologies (e.g., heat pumps, electric boilers) already in market.

- Carbon pricing in Europe and retrofit incentives are making electrification cost-effective.

- Low engineering complexity for retrofits compared to higher-temp systems.

- AtmosZero | Drop-in modular electric boilers.

- NextThermal | Electrified heat pump systems targeting sub-200°C.

2. Thermal Energy Storage (TES)

TES technologies are increasingly critical to enabling electrified heat systems by mitigating price volatility and intermittency of renewable energy sources. They offer high potential for integration with renewable power, especially where direct electrification is difficult or costly.

- Key enabler for flexible electrification strategies in both medium and high temperature ranges.

- Provides temporal decoupling between renewable energy supply and heat demand.

- Regulatory and grid signals (e.g., demand charges, peak shaving) improve economics.

Representative Startups

- Antora Energy | Solid-state thermal batteries for industrial use.

- Rondo Energy | Brick-based thermal storage with large industrial pilots.

- Lava | Thermal battery system with integrated heat engine for electricity and industrial heat delivery.

- RedoxBlox | Thermochemical TES platform focused on dispatchable high-temperature heat.

3. Electrochemical Reduction for Iron and Cement

Electrochemical methods for producing iron and cement are being explored as radical alternatives to fossil-fuel-based thermal processes. These include direct electrochemical reduction of iron ore and electrochemical conversion of limestone or other mineral feedstocks.

- Potential to bypass combustion entirely and eliminate CO₂ from key process steps.

- May integrate more directly with a renewable electricity supply.

- High strategic interest from corporates and investors focused on hard-to-abate sectors.

-

Electra | Electrochemical processing of nonferrous metals.

-

Helios | Electrochemical process for iron reduction.

-

Sublime Systems | Electrochemical process for cement production at ambient temperature.

Note: Hydrogen-ready boilers and burners are sometimes proposed as a transitional decarbonization solution, particularly in high-temperature industrial settings. However, current LCOH calculations show they are not cost-competitive without significantly lower prices for green or blue hydrogen. As such, we do not include them as a viable VC opportunity at this stage.

Emerging Opportunities

Technologies that do not yet meet our investability criteria—due to unresolved science risk or lack of cost visibility—but may become relevant in the future.

Categories to Watch

- Inductive Heating: Uses electromagnetic fields to heat conductive materials directly. Potentially efficient for high-temperature applications such as glass or steel processing, but challenges remain in retrofitting and scaling for large industrial systems.

- Shock Wave Heating (SWH): High-efficiency electric heating method that achieves extreme temperatures rapidly. Still early-stage, but could become relevant in high-temp chemical and materials processing.

- Plasma and RF Heating: Non-combustion high-temp methods with potential for integration in metals and materials processing.

- Next-Gen TES Materials: Advanced chemistries (e.g., thermochemical, phase change) that could push cost or temperature boundaries.

- High-Performance Materials: Coatings, ceramics, and composites for extreme environments not yet integrated into mainstream equipment.

References

- Lux Research (2025). Beyond the Flames: The Economics of Heat Generation.

- IEA (2023). Energy Technology Perspectives and World Energy Outlook.

- IPCC (2022). Sixth Assessment Report – Mitigation of Climate Change.